Let op! U belegt buiten AFM-toezicht. Geen vergunning- en

prospectusplicht voor deze activiteit.

Let op! U belegt buiten AFM-toezicht. Geen vergunning- en

prospectusplicht voor deze activiteit.BB Capital Fund Investments

Investeren in Private Equity. 10-15% jaarlijks rendement. Speciaal geselecteerde fondsen.

BB Capital Fund Investments verschaft toegang tot de exclusieve markt van hoogstaande private equity fondsen. Vanuit een jarenlange ervaring in private equity zijn wij in staat om een superieure selectie te maken van fondsen met een stabiel hoog rendement.

BB Capital Fund Investments

Investeren in Private Equity. 10-15% jaarlijks rendement. Speciaal geselecteerde fondsen.

BB Capital Fund Investments verschaft toegang tot de exclusieve markt van Europese private equity fondsen. Vanuit een jarenlange ervaring in private equity zijn wij in staat om een superieure selectie te maken van Europese fondsen met een stabiel hoog rendement.

BB Capital Fund Investments

Investeren in Private Equity

Wij bieden individuele investeerders de mogelijkheid om direct te investeren in een gespreide portefeuille met private equity beleggingen. Wij investeren uw kapitaal onafhankelijk en langjarig in de private equity sector met een duurzaam hoog rendement van 10-15% per jaar.

Dagelijks instappen

U kunt dagelijks toetreden tot onze actieve portefeuille met hoogstaande, internationale fondsen. Deelname is mogelijk vanaf €250.000. Meer weten? Download de brochure, neem deel aan een masterclass of maak meteen een persoonlijke afspraak.

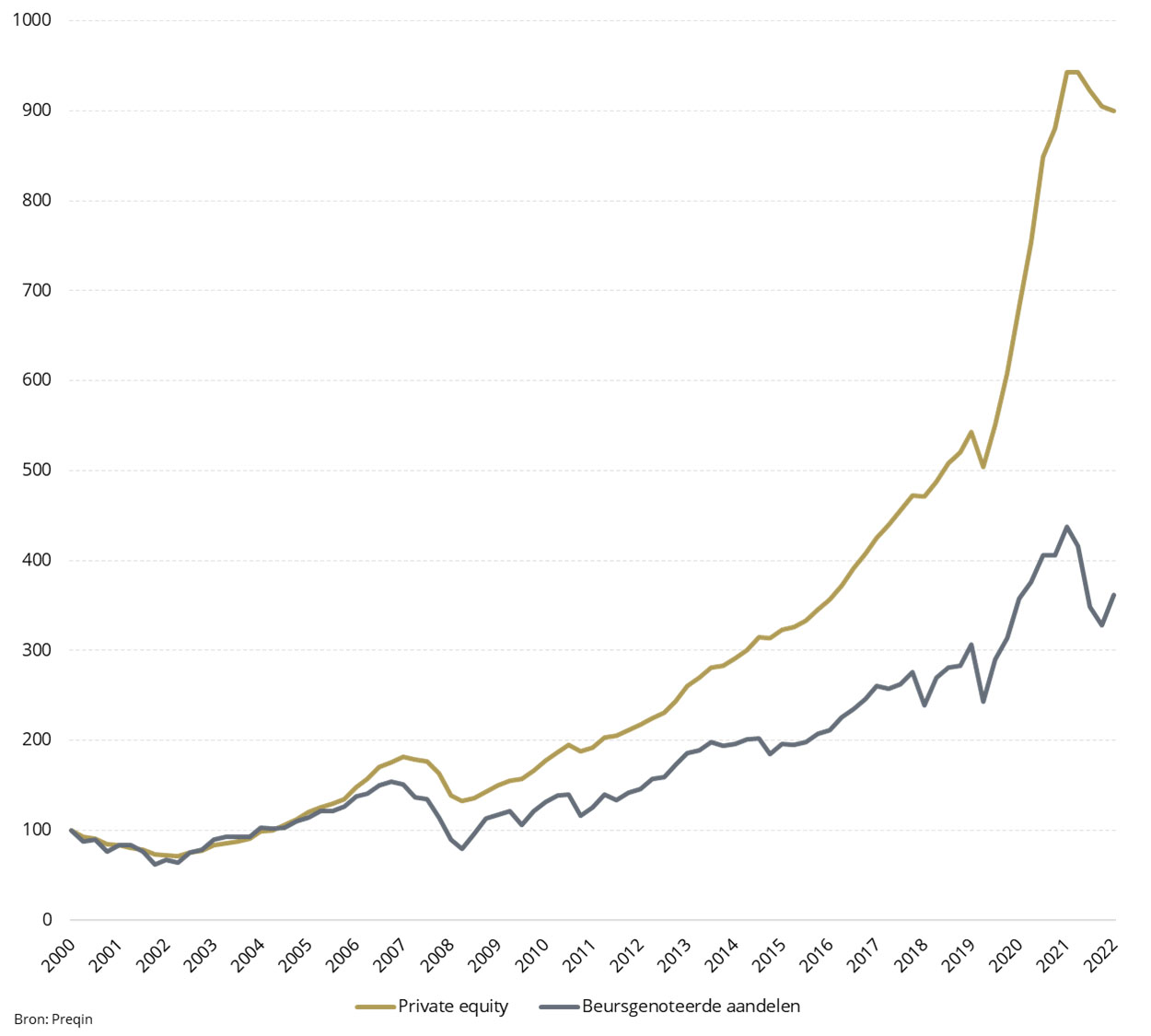

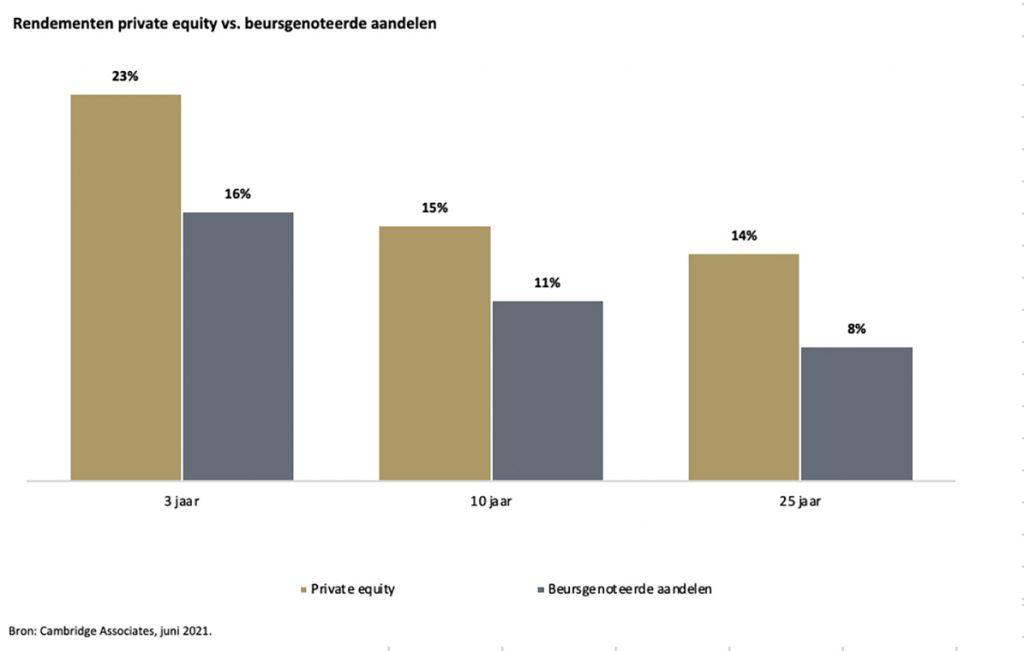

private equity vs. beursgenoteerde aandelen

Uw vermogen direct aan het werk

Unieke open

fondsstructuur

BB Capital Fund Investments is gebaseerd op een ‘evergreen’ structuur zonder vaste looptijd. De voordelen:

- U investeert in een actieve portefeuille van beleggingen waarmee uw vermogen vanaf dag één ‘aan het werk’ is

- U krijgt geen onverwachte capital calls

- Het rendement wordt per kwartaal uitgekeerd. U kunt het dividend automatisch herbeleggen

- Hoger absoluut rendement in vergelijking met andere fund-of-funds: 2,8x uw inleg in 12 jaar

* Indicatief rendement van een investering van €250.000 bij investeringsperiode van 12 jaar met 12% jaarlijks fondsrendement, netto na kosten

15,9%

Jaarlijks rendement

sinds oprichting

120 miljoen

23

Aantal fondsen

+ 7.000

+ 150

Investeerders vertellen

Elke investeerder is anders en heeft zijn of haar eigen verhaal en persoonlijke overwegingen om te investeren in private equity. Investeerders van BB Capital Fund Investments delen hun verhalen.

“Private equity is onderdeel

van investeringen voor…“

MICK

Jonge ondernemer Mick deelt zijn visie op een moderne beleggingsportefeuille en doelstellingen voor private equity.

wil je geld natuurlijk niet…”

MIKE

MARK & EDWIN

Dagelijks toetreden. Uw vermogen meteen aan het werk.

Wij bieden u de mogelijkheid om dagelijks toe te treden tot onze actieve portefeuille met hoogstaande, internationale fondsen. Deelname is mogelijk vanaf €250.000. Starten met hogere bedragen is ook mogelijk. Meer weten?

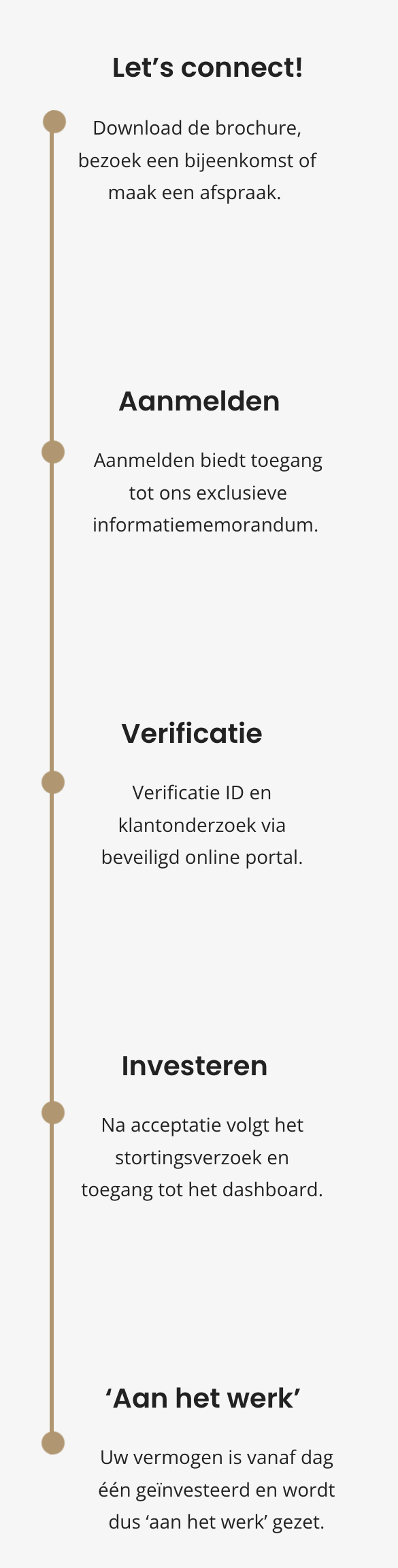

Download de brochure, bezoek een bijeenkomst of maak een afspraak. Aanmelden biedt toegang tot ons exclusieve informatiememorandum. Verificatie ID en klantonderzoek via beveiligd online portal. Na acceptatie volgt het stortingsverzoek en toegang tot het dashboard. Uw vermogen is vanaf dag één geïnvesteerd en wordt dus ‘aan het werk’ gezet.

Download de brochure, bezoek een bijeenkomst of maak een afspraak.

Aanmelden biedt toegang tot ons exclusieve informatiememorandum.

Verificatie ID en klantonderzoek via beveiligd online portal.

Na acceptatie volgt het stortingsverzoek en toegang tot het dashboard.

Uw vermogen is vanaf dag één geïnvesteerd en wordt dus ‘aan het werk’ gezet.

Let’s connect!

Aanmelden

Verificatie

Investeren

‘Aan het werk’

Dagelijks toetreden. Uw vermogen meteen aan het werk.

Wij bieden u de mogelijkheid om dagelijks toe te treden tot onze actieve portefeuille met hoogstaande, internationale fondsen. Deelname is mogelijk vanaf €250.000. Starten met hogere bedragen is ook mogelijk. Meer weten?

Download de brochure, bezoek een bijeenkomst of maak een afspraak. Aanmelden biedt toegang tot ons exclusieve informatiememorandum. Verificatie ID en klantonderzoek via beveiligd online portal. Na acceptatie volgt het stortingsverzoek en toegang tot het dashboard. Uw vermogen is vanaf dag één geïnvesteerd en wordt dus ‘aan het werk’ gezet.

Ontvang de uitgebreide brochure

Informatiebijeenkomst of webinar bijwonen?

Direct online inschrijven? Dat kan hier

BB Capital Investments is een professionele fondsbeheerder met meer dan vijftien jaar ervaring in de wereld van private equity. Maak kennis met ons team.

Ontmoet het

hele team

Private Equity Made Easy

BB Capital Investments

Wij zijn specialisten in private equity. Als private market investment manager hebben wij een unieke combinatie van directe investeringen en fonds in fonds beleggingen. Wij beheren de private equity portefeuille van meer dan 150 investeerders met een vermogen van meer dan EUR 120 miljoen. Ons motto? Private equity made easy.

Meer ervaren over private equity?

Private equity is een besloten wereld die van oudsher is gericht op banken en pensioenfondsen. De toetredingsdrempels van private equity fondsen zijn hoog, doorgaans vanaf EUR 5 miljoen bij toonaangevende internationale private equity fondsen. Er is ook diepgaande kennis nodig om de complexiteit van private equity te begrijpen.

De private equity sector is daardoor doorgaans niet toegankelijk voor particuliere investeerders. Via een fund-of-funds, zoals BB Capital Fund Investments, kan voor lagere bedragen geïnvesteerd worden, omdat deze fondsen het kapitaal van meerdere investeerders samenbrengen om zo voldoende omvang te bereiken om in meerdere fondsen te kunnen investeren. Dit biedt particuliere investeerders laagdrempelig toegang tot gespreid investeren in de private equity sector.

Door een actieve betrokkenheid bij de aansturing en de strategie van ondernemingen kunnen private equity fondsen hoge rendementen realiseren. Historisch gezien gemiddeld circa 13% per jaar volgens diverse internationale onderzoeken. Hierdoor is investeren in private equity een aantrekkelijk alternatief voor beleggen op de beurs of in vastgoed.

BB Capital Fund Investments biedt individuele investeerders eenvoudig toegang tot private equity met een uniek fonds. Dit fonds investeert uw vermogen onafhankelijk, gespreid en langjarig in de private equity sector, met een duurzame lange termijn rendementsdoelstelling van 10-15% per jaar.

- Het fonds investeert uw vermogen continu en gespreid in de Europese private equity sector.

- Het fonds richt zich op kwalitatief hoogstaande fondsen die uitgebreid zijn getoetst aan strenge selectiecriteria.

- Het fonds heeft een onbeperkte looptijd waardoor het rendement doorlopend wordt geoptimaliseerd.

- Instappen is jaarlijks mogelijk, uitstappen wordt door het fonds gefaciliteerd.

- Het fonds keert uw rendement op termijn jaarlijks uit.

- U kunt uw eigen risico-rendementsprofiel bepalen door gebruik te maken van preferente participaties.

Deelname in BB Capital Fund Investments is mogelijk vanaf EUR 250.000

BB Capital Investments is in 2007 opgericht door Susan van Koeveringe met het doel om private equity kapitaal en ondernemers samen te brengen. Bij de oprichting was het nog niet zo gebruikelijk voor private investeerders om direct te investeren in Nederlandse MKB ondernemingen. Dat heeft BB Capital Investments in deze periode mede mogelijk gemaakt. En met succes, want BB Capital Investments is een gevestigde naam in de top van de Nederlandse private equity sector. BB Capital Investments werkt met een team van ervaren professionals dat samen meer dan 50 jaar private equity ervaring heeft.

Grote (internationale) private equity fondsen zijn helaas nog steeds ontoegankelijk, terwijl de wens van particuliere beleggers om te kunnen investeren in private equity sterk toeneemt. Om deze markt open te breken is BB Capital Fund Investments in 2018 opgericht. Met de kennis en ervaring van direct investeren, is BB Capital Fund Investments de partner bij uitstek om een gespreid private equity fonds te beheren waarin de best presterende fondsen verzameld zijn. U krijgt hierdoor direct toegang tot deze interessante beleggingscategorie.

BB Capital Fund Investments is een bij de Autoriteit Financiële Markten geregistreerd beleggingsfonds.

Private equity investeert kapitaal van financiële instituten en vermogende families in snelgroeiende private bedrijven. Door een actieve betrokkenheid bij de aansturing en de strategie van deze ondernemingen kunnen private equity fondsen hoge rendementen realiseren van gemiddeld 13% per jaar. Hierdoor is investeren in private equity een aantrekkelijk alternatief voor beleggen op de beurs of in vastgoed.

De voordelen van investeren in private equity zijn:

- Private equity heeft invloed op resultaten: waardecreatie, net zoals ondernemers in hun eigen bedrijf.

- Door lange termijn horizon zeer geschikt voor vermogensopbouw en vermogensoverdracht.

- Private equity wordt niet gehinderd door het sentiment van de beurs.

- Private equity zorgt voor stabiliteit in een beleggingsportefeuille.

Bibliotheek

BB Capital Investments heeft zich ten doel gesteld om vermogende particulieren toegang te bieden tot private equity. Door de sector beter inzichtelijk te maken verwachten wij deze aantrekkelijke beleggingscategorie toegankelijker te maken. In onze Private Equity Bibliotheek publiceren wij artikelen die de private equity sector vanuit verschillende invalshoeken belichten.